BALTIMORE (Stockpickr) – Tick. Tick. Tick. Hear that? It's time slipping away between now and the end of 2013.

If you're a hedge fund manager, that's a very worrying sound. After all, with the S&P 500 up 25% since the start of the year after yesterday's record high close, performance expectations are high this year. And for the funds that were underexposed to stocks to start the year, that presents a real gap that needs to be filled before the calendar flips over to January again.

That's not just the case for a few select fund managers; as a group, hedge funds were underweight stocks coming into the year, and many bet on a down move in the S&P back in June. That means that there's lots of money in search of returns for the final months of the year.

And some stocks are attracting more hedge fund dollars than others this quarter...

So today, we'll take a look at the five stocks that hedge funds love the most right now. To do that, we're focusing on 13F filings.

Institutional investors with more than $100 million in assets are required to file a 13F -- a form that breaks down their stock positions for public consumption. From hedge funds to mutual funds to insurance companies, any professional investors who manage more than that $100 million watermark are required to file a 13F.

In total, approximately 3,400 firms file 13F forms each quarter, and by comparing one quarter's filing to another, we can see how any single fund manager is moving their portfolio around. While the data is generally delayed by about a quarter, that's not necessarily a bad thing – research shows that applying a lag to institutional holdings can generate positive alpha in some cases. That's all the more reason to crack open the moves being made with hedge funds $300 billion under management.

Today, we'll focus on hedge funds' 5 favorite stocks from the last quarter...

I've made no secret that I'm not a fan of Facebook's (FB) stock. Hedge fund managers don't have the same concerns right now – they picked up 5.35 million shares in the last quarter, boosting their positions in the social network by 50%. That means that hedge funds are making a $790 million bet on Facebook right now.

I'll concede that some things have changed. The technicals have made a complete about-face since I last talked about FB, and the fundamentals are... well, not horrific. But FB still has to do a lot in order to grow into its valuation. Until that happens, the firm has size on its side -- Facebook is the incumbent social networking site, drawing more time from users than any other destination on the web. The personal information on Facebook's servers is extremely valuable, and FB is using it to drive targeted ads. But Facebook needs to generate more revenues by adding value to the user experience, not detracting it with advertising that's only marginally relevant to what they're doing on the site.

Online gaming has been a perfect example of the direction that Facebook should be moving in, even if it makes some analysts nervous. Marketing intelligence is another. An abundance of net cash on its balance sheet gives FB the dry powder to invest in taking its business a step further. Even though hedge funds bought more shares of Facebook than any other name this past quarter, I'm still skeptical.

Apple

On the other hand, I am a fan of Apple (AAPL). I own it too. And so do hedge funds apparently -- funds picked up 119,000 shares of the tech giant in the latest quarter, raising their total bet on Apple to $2.39 billion.

Apple has spent most of 2013 as a hated stock. While the S&P 500 has absolutely rocketed this year, its biggest component has managed to slip around 2% year-to-date. Yes, ouch.

But the hate is very overblown -- despite all of the competition and risk, Apple remains a cash cow. Apple's margins are, by far, the biggest in the industry, and while the firm has ceded market share in order to keep margins, that decision has helped the firm hang onto the most lucrative segment of customers. iOS users spend more time on their devices than owners of other devices, and they spend more on apps too. With numbers in for the iPhone 5s and 5c, it's clear that the naysayers were wrong – and early on, the newest iterations of the iPad are moving fast for the holiday season.

Considering the dominance of the iOS products, the Macintosh has been on most analysts' back burners for years now. But that could change thanks to a new Mac Pro offering set to launch next month and refreshed MacBook Pros. The halo effect is still keeping consumers in the Apple ecosystem, and Apple's recently announced policy of free software updates should help spur more Mac-buying in the year ahead. With a mountain of cash on the books, Apple looks cheap right now.

General Motors

It's been a great year for carmakers, and that's shining through in shares of General Motors (GM) -- since the first trading session of the year, GM's shares have climbed more than 33%. Hedge fund managers must think that it'll keep on driving higher; that's why funds picked up 7.69 million shares of the Detroit automaker, ratcheting their position to $1.21 billion.

General Motors has had a tumultuous five years. The firm emerged from bankruptcy in 2009, after shedding a handful of unfruitful brands, unloading debt, and renegotiating union contracts. Worldwide, GM now operates 11 brands -- Chevrolet, Cadillac, GMC, and Buick are the survivors here in the U.S. Along with cost cutting, GM has found big success in ramping up build quality, churning out cars that consumers actually want to own again.

The end result has been profitability – record profitability, in fact. The firm's breakeven points are drastically lower after slashing hourly labor costs by more than two-thirds, and that means that GM can realistically compete with imports (including those assembled here in the U.S.) again. Even though GM is certainly an American icon, some of its biggest growth opportunities are coming from abroad right now. In fact, nearly 70% of GM vehicles are sold outside of North America today, with a huge share coming from emerging-market countries such as China and Brazil.

Now, with a combination of bullish technical and fundamental factors in play, General Motors' upside trajectory should carry on into the new year.

Williams Partners

You'd be forgiven for thinking that natural gas pipeline owner Williams Partners (WPZ) is a commodity-driven stock. It certainly seems like one at first glance. But while this master limited partnership owns one of the largest midstream natural gas operations in the country, it's not a commodity-driven play. It's an income play.

Williams owns one of the largest pipeline networks in the country, transporting natgas in huge volumes. It also operates a huge midstream operation that gathers and processes natgas with a focus on the lucrative Marcellus shale. But more than three-quarters of WPZ's cash comes from fee-based sources that aren't subject to swings in commodity prices (the firm makes most of its money by charging customers to transport their gas). That, and the tax advantages of a MLP, mean that this stock was basically purpose-built for building income. And a huge 7.05% dividend yield proves it.

After spending several years in acquisition mode, Williams owns a mature portfolio of assets that should continue to pay off in the years to come. Hedge funds made a big bet on WPZ, buying up 6.22 million shares in the most recent quarter. Collectively, that entitles funds to a $62 million dividend payout in the year ahead.

Starwood Property Trust

Clearly, hedge fund managers have income generation on their minds right now. That's the only explanation for their stakes in another super-high yield name this quarter: Starwood Property Trust (STWD). Funds picked up 13.5 million shares of the commercial mortgage REIT, mounting up a $504 million stake. Currently, STWD pays out a 7.07% yield.

Starwood invests in mortgage debt, earning the spread between their cost of capital (through either debt or equity offerings) and what they're able to collect from borrowers. The real secret to the mortgage REIT model is leverage; by taking on relatively low-risk assets (like agency backed securities), STWD can lever up its balance sheet dramatically without ramping up risk nearly as much. That's how the firm can pay out such a large yield to its investors.

As a real estate investment trust, STWD pays out around 90% of its income directly to shareholders without being subjected to corporate income taxes -- that makes it a purpose-built income-generation machine. A recently announced plan to spin off its residential landlord unit into a new publicly traded REIT called Starwood Waypoint Residential Trust. The move should unlock some extra value for shareholders, especially in the accommodative REIT IPO market we're seeing this year.

10 Best Oil Stocks To Watch For 2014

If you're looking for income exposure right now, you could do a lot worse than to follow hedge funds into STWD.

To see these stocks in action, check out the Winter 2013 Institutional Buys portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:>>4 Stocks Under $10 Moving Higher

>>5 Tech Stocks to Trade in November

>>2 Biotech Stocks Under $10 Triggering Breakouts

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author was long AAPL.

No doubt, mentioning mutual funds without mentioning Fidelity Investments is like discussing great gorilla movies without mentioning King Kong.

No doubt, mentioning mutual funds without mentioning Fidelity Investments is like discussing great gorilla movies without mentioning King Kong. Ben S. Bernanke

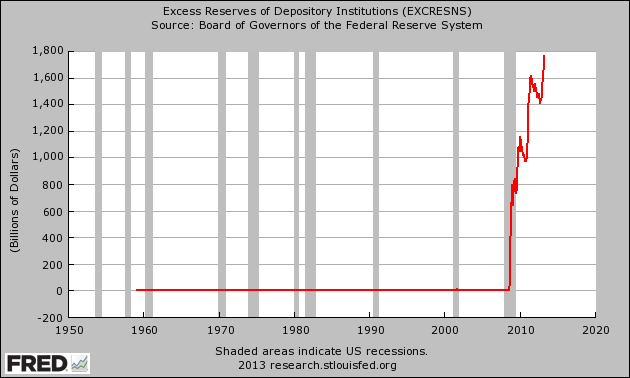

Ben S. Bernanke  To fund its massive quantitative easing (QE) program, the Fed has encouraged banks to deposit excess reserves in the Fed's accounts. The big banks have been more than happy to comply (see chart), as they get paid interest on any money they park at the Fed. Last year, the Fed paid out about $4 billion in interest to the big banks; Bloomberg News has estimated that the annual payments to the banks could soar as high as $77 billion a year by 2015, depending on how much interest rates rise by then.

To fund its massive quantitative easing (QE) program, the Fed has encouraged banks to deposit excess reserves in the Fed's accounts. The big banks have been more than happy to comply (see chart), as they get paid interest on any money they park at the Fed. Last year, the Fed paid out about $4 billion in interest to the big banks; Bloomberg News has estimated that the annual payments to the banks could soar as high as $77 billion a year by 2015, depending on how much interest rates rise by then.